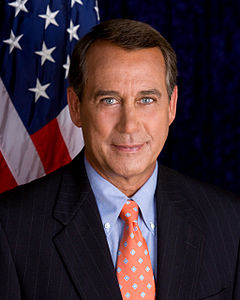

A Thought for Boehner

Congratulations, Mr. Speaker. I just sold off my stocks and it’s all thanks to you. You see, I remember that you created this crisis out of thin air. You could have just raised the debt ceiling. Easy-peasy. But no, you had to play politics with it. You and your Tea Party pals had to use it for leverage -- like you’re in an episode of Mr. Sterling or something.

I’ve not a active trader. As a matter of fact, I hate having to keep up with money. I’m just looking for someplace (relatively) safe to put my money and earn a decent return. I doubt if hundreds of people are going to follow my lead, but thinking about it gave me an idea.

I’m always looking for a way that controllers can exert their power -- legally. It occurred to me -- as you Republican union-haters like to point out -- that air traffic controllers are some of the highest-paid employees in the Federal government. In addition, when your Republican Party was busy destroying everyone’s pensions and forcing them into 401ks (FERS for Federal employees) you turned every Federal employee (and much of the general public) into an investor -- whether they were cut out to be one or not.

Are you paying attention here, Mr. Speaker? We’ve gone from pensions -- professional investors looking out for average worker’s retirement and investing in safe securities -- to turning a bunch of amateurs loose in “The Market”. Take away the regulatory agencies’ powers -- another Republican hallmark -- and you’ve turned the wolves loose on the sheep. Average working stiffs at the mercy of the best and brightest professional traders Wall Street can lure out of the best colleges in the world. Gordon Gekko versus The Waltons.

Last Friday, your buddy John Mica got 4,000 FAA employees furloughed. He might be able to lie his way out of it with the rest of the country but air traffic controllers know that Mica was playing politics with the FAA Reauthorization Bill. Just like you are playing with the debt ceiling. Mica has turned a standard housekeeping measure into a crisis -- just to harm unions.

About those air traffic controllers...suppose they did follow my advice and sold all their stocks? What would your Wall Street buddies think of that? We have figured it out you know? Every payday, about 10% of the Federal payroll has to get invested in something. That’s the way FERS -- Federal Employees Retirement System -- works. A lot of that money goes into Wall Street’s pocket. Suppose it stopped?

Here, let me give you some numbers:

Federal Retirement Thrift Investment Board

”The Thrift Savings Plan is one of the three parts of the Federal Employees Retirement System, and is the largest defined contribution plan in the world with over 3.7 million participants and assets worth over $244 billion dollars. ”

I wonder which number gets the most attention -- 3.7 million voters or $244 billion?

Suppose 3.7 million voters (you know they vote) took 244 billion dollars out of all the other funds and put their money in the G Fund? (Out of stocks and bonds and into government securities.) Would that get your attention Mr. Speaker? I bet it would get Wall Street’s attention.

I could type this whole idea out in detail but it would take a while to connect all the dots. Let me just outline it for my readers. The Federal government’s highest paid employees hire their own financial advisor. Not to maximize returns but to keep their retirement funds safe. Controllers start trading as a bloc of investors -- voluntarily. They then give this financial advice away to other unions, government employees and maybe even the General Public. There’s nothing you can do about it. It’s voluntary and it’s free.

Remember, the idea is no-hassle safety -- not get rich quick. People my age (and those that can think this through) know this sounds familiar. Unions used to be (and still are) in charge of some pension funds. And professional advisors were required to invest in safe securities -- those securities rated AAA. (Is it starting to dawn on you now?)

That’s right, pension funds -- the really Big Money -- were raided when Wall Street was able to get Mortgage Backed Securities -- backed by sub-prime loans (what we now call toxic assets) -- rated as AAA (Triple A) investments. Have you got the Flick now? America’s retirement funds -- both pensions and 401ks -- were stolen by Wall Street. The trick now is to keep the masses from figuring it all out. They understand they’ve lost the present -- that Wall Street stole the value of their house. What they haven’t figured out yet is that Wall Street stole their future too.

You might want to solve the debt celling problem you created real quick, Speaker Boehner. If someone that hates investing as much as I do starts having these thoughts, others that like investing will figure it out too. And we have plenty of people in government that like investing. Some of them like it a little too much. But that’s another story.

(Just for clarity, I sold most of my “personal” portfolio. I haven’t touched my TSP account in years. But if this goes much further, that might change. And don’t take financial advice from me. I say again, I hate investing.)

Don Brown

July 27, 2011

Comments